A Process Costing System Does Which of the Following

Process costing is widely used in industries such as oil refining food production chemical processing textiles glass cement and paint manufacture. A a health-care service provider B a music production studio C a paint manufacturer D a home remodeling contracting company.

Managerial Accounting Process Cossting Accounting Process Managerial Accounting Accounting Education

Produces items by special request of customers.

. The assumption is that the cost of each unit is the same as that of any other unit so there is no. Does not use a Work in Process account in any form. Variances can be measured during the production period.

Choose either process costing or job order costing A costing system used by a chemical manufacturer Drag answer here A costing system used by a tire manufacturer Drag answer here A costing system used by a food processing company Drag answer here A costing system used by an architectural firm Drag. Homogeneous indicates that the units of output are relatively indistinguishable from one another. Variances can be measured during the production period.

Features of Process Costing 3. Many industries commonly use process costing among which petroleum paper agricultural chemical textile and lumber. Calculates average cost Determines total units to per whole unit account for.

A job order costing system does which of the following. When standard costs are used in process costing a. For instance large manufacturing companies that mass-produce inventory might use process costing to calculate the total amount of direct and indirect costs associated with products that are completed and left in-process at the end of a.

A process costing system is used by a company that. Accumulates costs by job. April 17 2022.

Process costing refers to a cost accounting method that is used for assigning production costs to mass-produced goods. Processes costing typically employ the weighted average method. Process costing calculations are made simpler.

Uses a separate Work in Process account for each type of product produced. Both A and B E. D An accounting firm would likely use a job order costing.

In job order costing the company tracks the direct materials the direct labor and the manufacturing overhead costs to determine the cost of goods manufactured COGM. Which of the following is not used in service costing. A job order costing system does which of the following.

Use a process costing system. Allocates manufacturing costs to individual jobs to determine unit costs D. Alternatively process costing that is based on standard costs is required for costing systems that use standard costs.

The cost per. The process costing method is in contrast to other costing methods such as product costing job costing or operation costing systems. Process costing calculations are made simpler.

Which of the following is the best explanation of the relevance of equivalent production units in process costing. A job order cost system uses only one work in process account whereas a process cost system uses multiple work in process account. It is also useful in situations where companies manufacture such a broad mix of products that they have difficulty accurately assigning actual costs to each type of product.

Under the other process costing methodologies which. Uses a single Work in Process account for the entire company. For Which One Of The Following Industries Would You Recommend A Process Costing System.

Calculates EUPs Assigns costs to inventories. Monthly conversion costs are allocated between ending work in process and units completed. None of the above.

Definition of Process Costing. Is used to determine unit costs when products are manufactured in a continuous flow process C. A process costing system.

A process costing system accumulates costs when a large number of identical units are being produced. It is used commonly in manufacturing units like paper steel soaps medicines vegetable oils paints rubber chemical etc. Process costing systems allocate expenses to products by adding total costs at each stage of the manufacturing process then dividing these costs by the total number of units produced.

Uses a separate Work in Process account for each processing department. The weighted average method of calculating EUPs makes computing transferred-out costs easier. When standard costs are used in process costing a.

Process costing is method of costing wherein the products go through two or more processes and the costs are assignedcharged to individual processes or operations which is averaged over the number of units produced during the said period. Is used to determine period costs in a service company B. Process costing is appropriate for companies that produce a continuous mass of like units through series of operations or process.

A process costing system. Using the process costing method is optimal under certain conditions. A process costing system does which of the following.

Process Losses and Gains. In this situation it is most efficient to accumulate costs at an aggregate level for a large batch of products and then allocate them to the individual units produced. C A construction company would likely use a process costing system.

Which of the following statements is true of costing systems. Total costs rather than current production and current costs are used. Choose the most likely used costing system for the industries listed below.

Definition of Process Costing 2. Total costs rather than current production and current costs are used. Would a process cost system be appropriate.

Is used to determine unit costs when products are manufactured in a continuous flow process C. A A process costing system would be used by manufacturers of custom-made perfumes B A job order costing system would be used by manufacturers of baking utensils. Approximately the same number of physical units at the same degree of completion were in work in process at the end of both January and February.

Asked Sep 24 2015 in Business by Transviolet. Which of the following would use a process costing system rather than a job order costing system. When using process costing companies determine item cost by tracking the cost of each stage in the production process then divide the total cost by the number of items produced.

Both a job order and process cost system track the same three manufacturing cost elements - Direct material Direct labour and manufacturing overhead. Also when one order does not affect the production process and a standardization of the process and product exists. The method includes a few basic steps to make sure costs are.

CIMA defines Process Costing as the costing method applicable where goods or services result from a sequence of continuous or repetitive operations or processes costs are averaged over the units produced during the period. The weighted average method of calculating EUPs makes computing transferred-out costs easier. A process costing system was used for a department that began operations in January.

In process cost computations the cost of ending work in process inventory is calculated on the ____________.

Xiaoqian Chen This Picture Describes The Job Order Cost Flow Process That Related To Chapter 17 The Job Order Costing System I Think It Helps Us To Easier Un

Comparison Of Job Costing With Process Costing Managerial Accounting Cost Accounting Accounting Education

Describes Job Order Costing Accounting Basics Managerial Accounting Information And Communications Technology

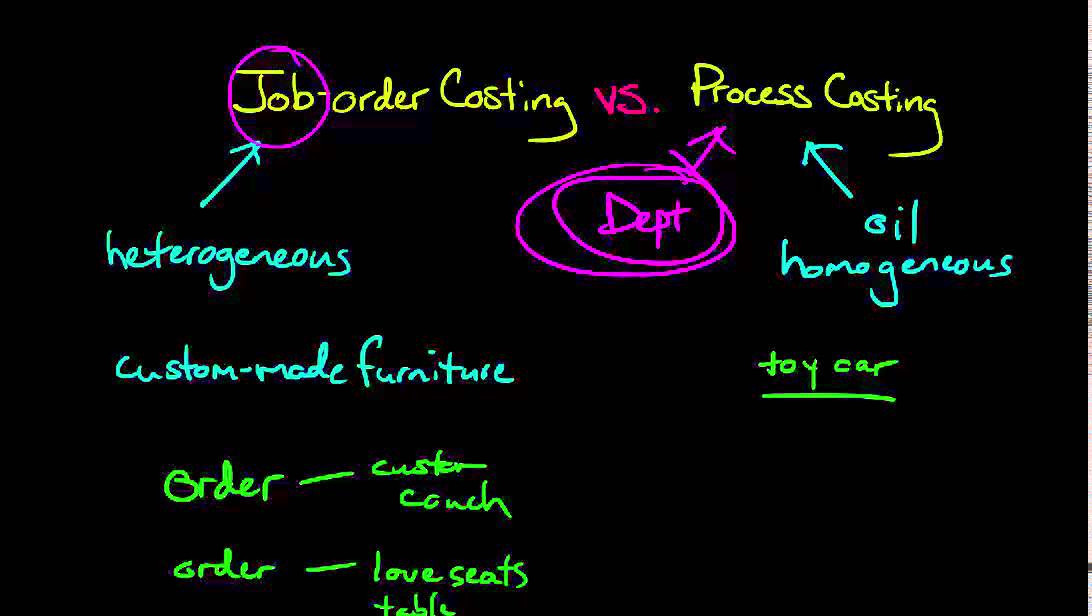

Tsedenya Gebreyesus In This Video He Explains And Goes Into Details About The Differences Of Job Order Costing And Process Costing He Job Relatable Process

Inventory Costing Bookkeeping Business Accounting Basics Inventory Accounting

Amani Benn This Is A Diagram That Shows The Order We Follow When Using The Process Costing System I Am A Visual Learner So Diagrams Help Me Memorize Key Infor

Method For Estimating Working Capital Requirement Financial Life Hacks Accounting And Finance Learn Accounting

Mario Armendariz This Pin Helps Explain The Difference Between The Job Costing And Process Costing Systems I Found This Helpful Because It Job System Process

Batch Costing Method Double Entry Bookkeeping Learn Accounting Accounting Principles Accounting And Finance

Inventoriable And Period Costs Cost Accounting Accounting And Finance Financial Strategies

Cost Accumulation Meaning Types And More Accounting Education Accounting Principles Cost Accounting

Absorption Vs Variable Costing Accounting Basics Accounting And Finance Variables

Job Costing Meaning Benefits Process And More Learn Accounting Accounting And Finance Financial Management

Which Of The Following Would Be Accounted For Using A Job Order Cost System In 2022 Accounting Job System

Cost Allocation Meaning Importance Process And More Accounting Education Learn Accounting Bookkeeping Business

Cost Costing Cost Accounting And Cost Accountancy Cost Accounting Accounting Accounting Student

Activity Based Budgeting Budgeting Accounting Principles Website Development Process

Safety Stock Meaning Importance Formula And More Safety Stock Accounting And Finance Economic Order Quantity

Comments

Post a Comment